Did you experience damage to your home due to 2024 severe storms and flooding?

-

Homeowners must first finance repairs with private insurance and federal assistance. Complete these steps: 1. Contact your insurance company and submit a claim. 2. Submit federal applications. After October 27, 2024, homeowners should call each program and ask how to apply: o Federal Emergency Management Agency (FEMA) 800.621.3362 o Small Business Administration (SBA) 800.659.2955

Disaster Recovery Loan Program

Applications Are Now Being Accepted

The Minnesota Housing Disaster Recovery Loan Program is accepting applications in response to the severe storms and flooding in Minnesota between June 16 and July 4, 2024.

The Disaster Recovery Loan Program offers loans to eligible individuals whose home sustained damage because of a natural disaster. The program is a last resort when private insurance and federal assistance are not adequate to return a damaged home to its pre-disaster condition.

Loans can be used for the cost of repairs, not already covered by other assistance, to return a homeowner's existing home or eligible rental property to a habitable condition.

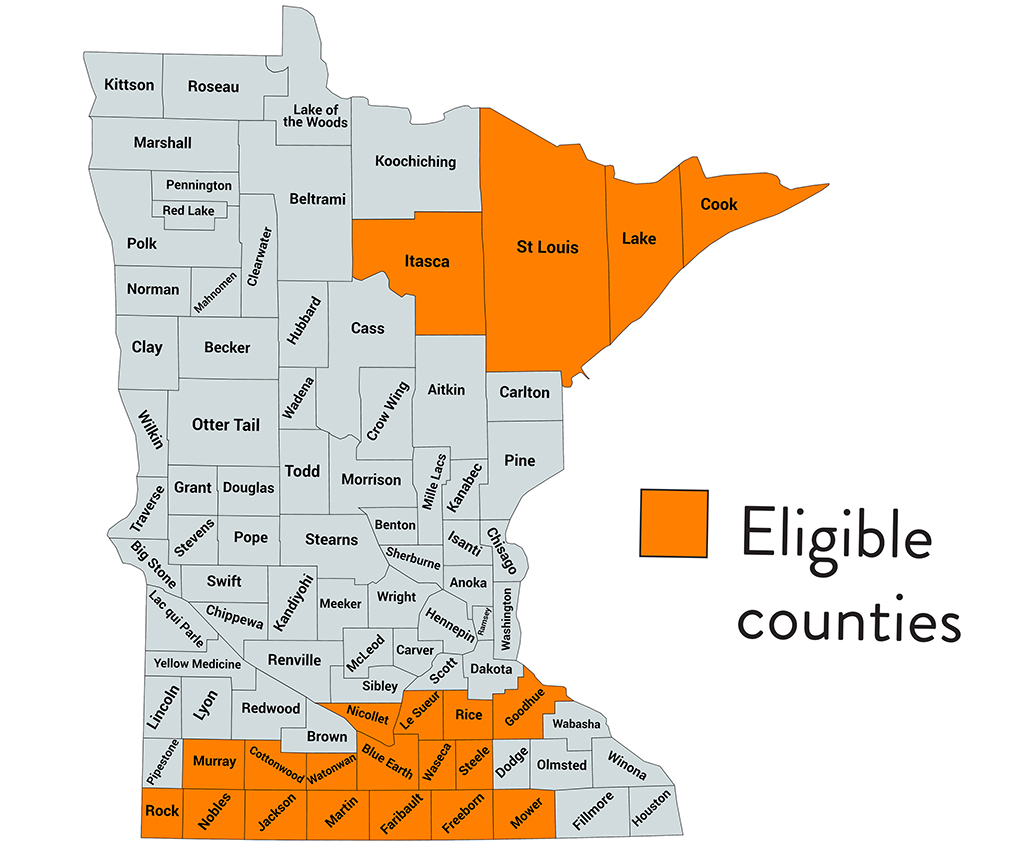

Eligible Counties - Applications are due by April 30, 2025

To find out more and apply for the program, contact the participating Disaster Recovery Loan Program lender serving your community:

- Learn about program guidelines and terms

- Get answers to your questions

- Find out what resources are available in your area

Cook, Itasca, Lake and St. Louis Counties:

Arrowhead Economic Opportunity Agency

2900 E Beltline, Suite 9, Hibbing, MN 55746

Contact: Beth Davies at beth.davies@aeoa.org or 218.735.6819

Cottonwood, Blue Earth, Faribault, Jackson, Le Sueur, Martin, Nicollet, Waseca and Watonwan Counties:

Minnesota Valley Action Council, Inc.

706 N Victory Drive, Mankato, MN 56001

Contact: Judd Schultz at jschultz@mnvac.org or 507.345.2401

Freeborn, Goodhue, Mower, Rice and Steele Counties:

SEMCAC

204 S Elm Street, PO Box 549, Rushford, MN 55971

Contact: Cindy Vitse at Cindy.Vitse@semcac.org or 507.864.7741

Murray, Nobles and Rock Counties:

Southwestern Minnesota Opportunity Council, Inc.

1106 Third Avenue, Worthington, MN 56187

Contact: Karie Bursell at kbursell@smoc.us or 507.376.4195

Other Resources

You may also be able to find help through the following organizations:

- Red Cross

- United Way 211 (for 2024 severe storms and flooding only)

- Disaster Distress Helpline

- Minnesota Department of Commerce Disaster Information Center

- Veterans Linkage Line

Questions?

In connection with Single Family Division loan programs, Minnesota Housing does not make or arrange loans. It is neither an originator nor creditor and is not affiliated with any Lender. The terms of any mortgage finance transactions conducted in connection with these programs, including important information such as loan fees, the annual percentage rate (APR), repayment conditions, disclosures, and any other materials which are required to be provided to the consumer are the responsibility of the Lender.